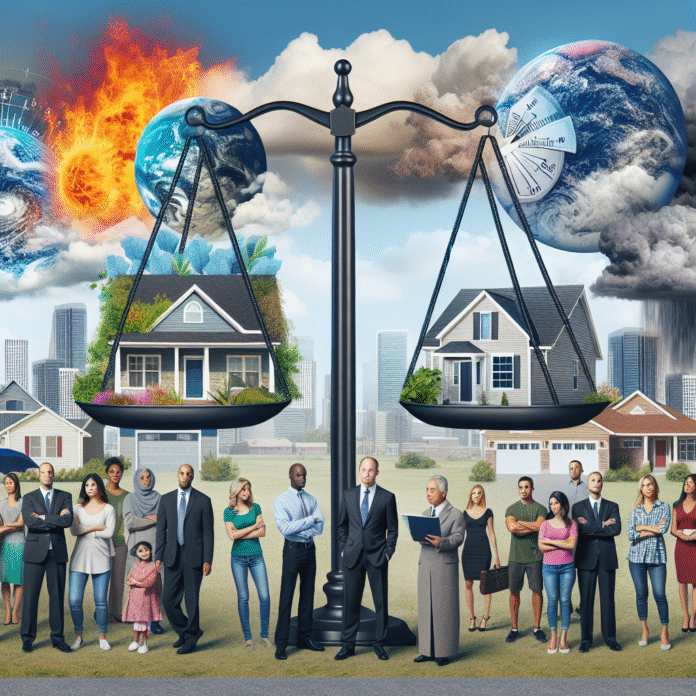

Is It Fair for Homeowners to Expect Insurance as Climate Conditions Evolve?

“`html

Should Homeowners Have the Right to Insurance Amid Climate Change?

As climate change intensifies, the question of whether homeowners should have a right to insurance has become increasingly pertinent. Extreme weather events, rising sea levels, and unpredictable climate patterns are reshaping the landscape of property ownership and insurance coverage.

The Impact of Climate Change on Homeowners

Homeowners are facing new risks as natural disasters become more frequent and severe. Events such as hurricanes, wildfires, floods, and droughts pose significant threats to property. As these risks escalate, homeowners are left wondering if they can adequately protect their investments. The growing prevalence of such threats raises fundamental questions about the responsibilities of insurance companies and the rights of homeowners.

The Role of Insurance Companies

Insurance companies play a crucial role in mitigating the financial impact of climate-related disasters. However, many homeowners find their coverage options limited or premiums skyrocketing due to perceived risks. Insurers often reevaluate their policies based on historical data, which may not accurately reflect future climate scenarios. As a result, some homeowners may struggle to find affordable coverage or may be denied insurance altogether.

Legal and Ethical Considerations

From a legal standpoint, the right to insurance can be viewed as a necessary aspect of property ownership. Homeowners invest significant resources into their properties, and having access to reliable insurance is essential for safeguarding those investments. Ethically, it raises questions about equity—should homeowners in high-risk areas be left without coverage, while those in less vulnerable regions enjoy full protection?

Potential Solutions

To address these challenges, a multi-faceted approach is needed. Policymakers could consider implementing regulations that require insurance companies to offer coverage in high-risk areas, perhaps through government-backed insurance programs. Additionally, investing in climate resilience and infrastructure improvements can help reduce risks and, in turn, lower insurance premiums.

Conclusion

As the climate continues to change, the conversation surrounding homeowners’ rights to insurance will only grow more critical. It is essential for lawmakers, insurers, and communities to work together to ensure that all homeowners have access to the protection they need to navigate an uncertain future.

“`