Effects of Climate Change on Housing and Insurance Sectors

“`html

Climate Change’s Effects on the Housing Market and Insurance Sector

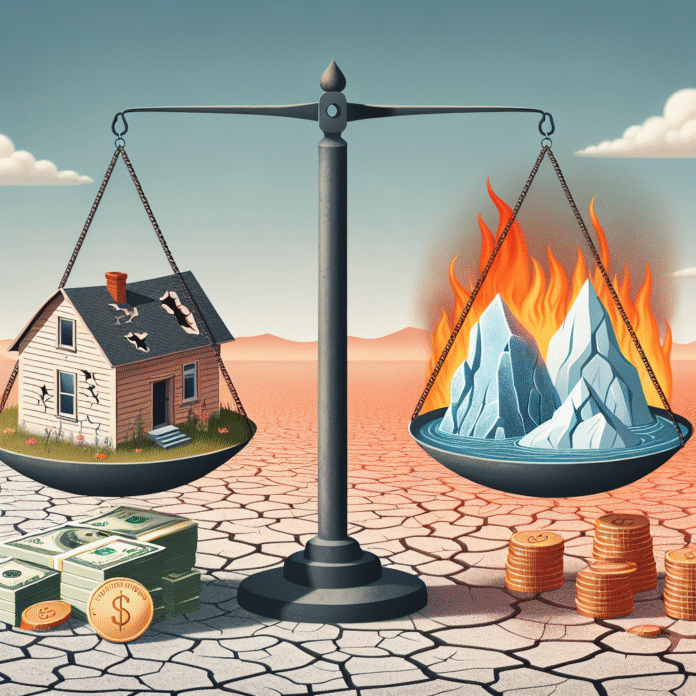

The repercussions of climate change are increasingly evident, with significant implications for both the housing market and the insurance industry. As extreme weather events become more frequent and severe, the landscape of real estate is shifting in ways that are hard to ignore.

Impact on Property Values

Areas prone to natural disasters such as floods, hurricanes, and wildfires are witnessing a decline in property values. Homebuyers are becoming more cautious, often avoiding regions that are deemed high-risk due to climate-related threats. This shift in buyer sentiment can lead to a decrease in demand for properties in vulnerable areas, consequently driving down prices.

Insurance Challenges

The insurance industry is also feeling the strain of climate change. As the frequency and intensity of claims rise due to environmental hazards, insurers are reevaluating their policies and coverage options. Many companies are increasing premiums or withdrawing coverage altogether in high-risk areas, making it more challenging for homeowners to secure affordable insurance. This trend not only affects individual homeowners but also has broader implications for the housing market as a whole.

Regulatory Responses

In response to these challenges, some local governments are implementing regulations aimed at mitigating climate risks, such as stricter building codes and zoning laws. These measures are designed to promote sustainable development and reduce vulnerability to climate impacts. Homebuyers are increasingly considering these regulations as part of their purchasing decisions, which can further influence market dynamics.

Investment in Resilience

As awareness of climate risks grows, there is a burgeoning market for properties that incorporate sustainable features and resilience strategies. Homebuyers are increasingly interested in energy-efficient designs, flood-resistant construction, and other innovations that can enhance a property’s longevity in the face of climate change. This trend is prompting builders and developers to adapt their practices to meet the demand for greener, more resilient housing options.

Conclusion

The intersection of climate change, the housing market, and the insurance industry is a complex and evolving landscape. As the effects of climate change continue to unfold, stakeholders across these sectors must adapt to the new realities. By embracing sustainable practices and proactive risk management, they can better navigate the challenges posed by a changing climate and ensure a more resilient future for the housing market.

“`